American Bitcoin Reports Third Quarter 2025 Results

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Suspendisse varius enim in eros elementum tristique. Duis cursus, mi quis viverra ornare, eros dolor interdum nulla, ut commodo diam libero vitae erat. Aenean faucibus nibh et justo cursus id rutrum lorem imperdiet. Nunc ut sem vitae risus tristique posuere.

MIAMI, FL, November 14, 2025 – American Bitcoin Corp. (Nasdaq: ABTC) (“American Bitcoin” or the “Company”), a Bitcoin accumulation platform focused on building America’s Bitcoin infrastructure backbone, today reported its financial results for the quarter ended September 30, 2025.

“The third quarter validated the thesis behind American Bitcoin,” said Eric Trump, Co-founder and Chief Strategy Officer of American Bitcoin. “While others paid spot, we generated Bitcoin below market through

scalable, asset-light mining operations. Coupled with disciplined at-market purchases, we added more than 3,000 Bitcoin to our reserve. This dual strategy is how we intend to compound value for our shareholders and solidify our position as a capital-efficient platform for long-term Bitcoin accumulation.”

“Our third-quarter performance reflects the speed, discipline, and precision with which we are executing against our differentiated Bitcoin accumulation model,” said Michael Ho, CEO of American Bitcoin. “We more than doubled our mining capacity, more than doubled revenue, and grew gross margin by seven percentage points quarter-over-quarter.”

Third Quarter 2025 Highlights

- Strategic Reserve Growth: Acquired more than 3,000 Bitcoin through Bitcoin mining and strategic at-market purchases, increasing total holdings to 3,418 Bitcoin1 held in reserve as of September 30, 2025, equivalent to 371 Satoshis Per Share2 (SPS).

- Topline and Margin Expansion: More than doubled revenue and increased gross margin from 49% to 56% quarter-over-quarter3, reinforcing the Company's growth trajectory, focus on cost efficiency, and the strategic advantages of its dual accumulation model.

- Nasdaq Debut: Began trading under the ticker symbol “ABTC” following the completion of a stock-for-stock merger with Gryphon Digital Mining, Inc.

- Mining Platform Expansion: Scaled Bitcoin mining capacity by approximately 2.5x quarter-over-quarter, adding approximately 14.8 exahash per second (EH/s) of capacity to reach a total of ~25.0 EH/s4 with an average fleet efficiency of ~16.3 joules per terahash (J/TH) as of September 30, 2025.

1. Includes 2,385 Bitcoin pledged or otherwise collateralized.

2. Represents the amount of Bitcoin attributable to each outstanding share of the Company’s common stock. SPS is calculated by multiplying the Company’s total Bitcoin holdings by the Satoshi conversion ratio (1 Bitcoin equals 100,000,000 Satoshis), then dividing that total by the number of shares of the Company’s common stock outstanding as of the measurement date.

3. The historical figures of the Company’s financial results for the three months September 30, 2024 reflect American Bitcoin’s operations as the “Bitcoin mining” sub-segment of Hut 8 Corp.’s “Compute” segment. The Company’s financial results for the three months ended September 30, 2025 reflect American Bitcoin Corp.’s results as a standalone entity.

4. Of total hashrate, ~21.9 EH/s was operational as of September 30, 2025.

Select Third Quarter 2025 Financial Results

Prior to March 31, 2025, American Bitcoin’s operations represented the “Bitcoin mining” sub-segment of Hut 8 Corp.’s “Compute” segment and not as a standalone company. On March 31, 2025, pursuant to a Contribution and Stock Purchase Agreement, Hut 8 Corp. contributed substantially all of its Bitcoin miners, representing American Bitcoin’s business, to American Data Centers, Inc., in exchange for 80% of the issued and outstanding equity interests of American Data Centers, Inc., after giving effect to the issuance (the “Transaction”). In connection with the Transaction, American Data Centers, Inc. was renamed American Bitcoin Corp.

On May 9, 2025, Gryphon Digital Mining, Inc. and certain of its subsidiaries entered into an Agreement and Plan of Merger (the “Merger Agreement”) with American Bitcoin Corp. On September 3, 2025, in accordance with the terms of the Merger Agreement, American Bitcoin Corp. and Gryphon Digital Mining, Inc. completed a stock-for-stock merger (the “Merger”).

American Bitcoin Corp. was deemed the accounting acquirer in the Merger and, as a result, the historical figures of the Company’s financial results for the three and nine months ended September 30, 2024 reflect American Bitcoin’s operations as the “Bitcoin mining” sub-segment of Hut 8 Corp.’s “Compute” segment. The Company’s financial results for the three months ended September 30, 2025 reflect American Bitcoin Corp.’s results as a standalone entity. The Company’s financial results for the nine months ended September 30, 2025 reflect three months of American Bitcoin’s operations as the “Bitcoin mining” sub-segment of Hut 8 Corp.’s “Compute” segment and six months of American Bitcoin Corp.’s results as a standalone entity following the completion of the Transactions.

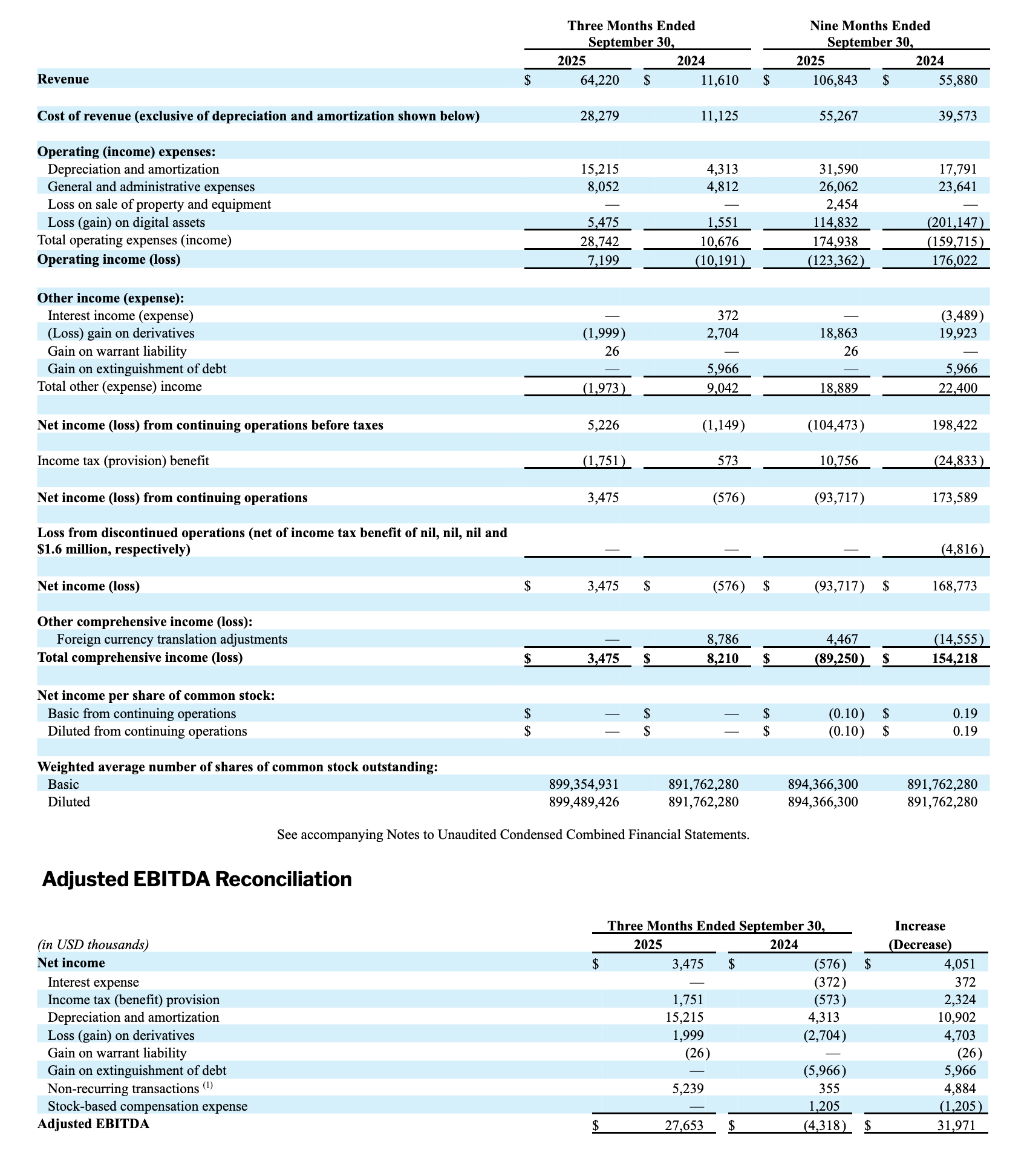

Revenue for the three months ended September 30, 2025 was $64.2 million compared to $11.6 million in the prior-year period. Net income for the three months ended September 30, 2025 was $3.5 million compared to net loss of $0.6 million for the prior-year period. This included a loss on digital assets of $5.5 million and $1.6 million for the three months ended September 30, 2025 and 2024, respectively. Adjusted EBITDA for the three months ended September 30, 2025 was $27.7 million compared to ($4.3) million for the prior-year period. A reconciliation of Adjusted EBITDA to the most comparable GAAP measure, net income, and an explanation of this measure has been provided in the table included below in this press release.

All financial results are reported in U.S. dollars.

Conference Call

The American Bitcoin Corp. Third Quarter 2025 Conference Call will commence today, Friday, November 14, 2025, at 8:30 a.m. ET. Investors can join the live webcast at https://app.webinar.net/k7EyDxgABWV.

Supplemental Materials and Upcoming Communications

The Company expects to make available on its website and/or official social media channels certain materials and updates designed to accompany the discussion of its results, along with certain supplemental financial information and other data, including regarding its Bitcoin holdings, Satoshis per Share (SPS), and related performance metrics. For important news and information regarding the Company, including investor presentations and timing of future investor conferences, visit the Investor Relations section of the Company's website, abtc.com/investors, and its social media accounts, including on X, Instagram, and LinkedIn. The Company uses its website and social media accounts as primary channels for disclosing key information to its investors, some of which may contain material and previously non-public information.

About American Bitcoin

American Bitcoin Corp., a majority-owned subsidiary of Hut 8 Corp., is a Bitcoin accumulation platform focused on building America’s Bitcoin infrastructure platform. The Company delivers institutional-grade exposure to Bitcoin through an industry-first business model that integrates scaled Bitcoin mining operations with disciplined accumulation strategies. For more information, visit abtc.com and follow the Company on X at @ABTC.

Cautionary Note Regarding Forward-Looking Statements

This press release includes “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Rule 175 promulgated thereunder, and Section 21E of the Securities Exchange Act of 1934, as amended, and Rule 3b-6 promulgated thereunder, which statements involve inherent risks and uncertainties. Examples of forward-looking statements, include, but are not limited to, statements relating to the Company’s ability to execute on its thesis, compound value for its shareholders, solidify its position as a capital-efficient platform for long-term Bitcoin accumulation, execute against its differentiated Bitcoin accumulation model with speed, discipline, and precision, remain focused on its growth trajectory, cost efficiency, and the strategic advantages of its dual accumulation model and the Company’s future business strategy, competitive strengths, expansion, and growth of the business and operations more generally.

Forward-looking statements are not statements of historical fact, but instead represent management’s expectations, estimates, and projections regarding future events based on certain material factors and assumptions at the time the statement was made. While considered reasonable by the Company as of the date of this press release, such statements are subject to known and unknown risks, uncertainties, assumptions and other factors that may cause the actual results, level of activity, performance, or achievements to be materially different from those expressed or implied by such forward-looking statements, including, but not limited to: the price of Bitcoin and concentration of Bitcoin holdings; failure to grow hashrate; the purchase of miners; competition from other methods of investing in Bitcoin; uncertainty in the development and acceptance of the Bitcoin network; reliance on third-party mining pool service providers; hedging transactions; Bitcoin halving events; failure to realize the anticipated benefits of the merger transactions; dependence on Hut 8; liquidity constraints and failure to raise additional capital; failure of critical systems; competition from current and future competitors; changes in leasing arrangements; hazards and operational risks; electrical power requirements; geopolitical, social, economic, and other events and circumstances; cybersecurity threats and breaches; Internet-related disruptions; dependence on key personnel; having a limited operating history; rapidly changing technology; predicting facility requirements; acquisitions, strategic alliances or joint ventures; operating and expanding internationally; legal, regulatory, governmental, and technological uncertainties; physical risks related to climate change; involvement in legal proceedings; stock price volatility; the Company's multi-class capital structure and status as a controlled company; and other factors that may affect the future business, results, financial position and prospects of the Company. Additional factors that could cause results to differ materially from those described above can be found in the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2024, the proxy statement/prospectus filed by the Company with the U.S. Securities and Exchange Commission (the “SEC”) on July 31, 2025, in the Company’s Current Report on Form 8-K filed with the SEC on September 3, 2025 and in other documents filed by the Company from time to time with the SEC.

Adjusted EBITDA

In addition to our results determined in accordance with GAAP, we rely on Adjusted EBITDA to evaluate our business, measure our performance, and make strategic decisions. Adjusted EBITDA is a non-GAAP financial measure. We define Adjusted EBITDA as net income or loss, adjusted for impacts of interest expense, income tax provision or benefit, depreciation and amortization, loss or gain on derivatives, gain on warranty liability, gain on debt extinguishment, the removal of non-recurring transactions, and stock-based compensation expense in the period presented. You are encouraged to evaluate each of these adjustments and the reasons our Board and management team consider them appropriate for supplemental analysis.

The Company’s board of directors and management team use Adjusted EBITDA to assess its financial performance because it allows them to compare operating performance on a consistent basis across periods by removing the effects of capital structure (such as varying levels of interest expense and income), asset base (such as depreciation and amortization), and other items (such as non-recurring transactions mentioned above) that impact the comparability of financial results from period to period.

Net income (loss) is the GAAP measure most directly comparable to Adjusted EBITDA. In evaluating Adjusted EBITDA, you should be aware that in the future the Company may incur expenses that are the same as or similar to some of the adjustments in such presentation. The Company’s presentation of Adjusted EBITDA should not be construed as an inference that its future results will be unaffected by unusual or non-recurring items. There can be no assurance that the Company will not modify the presentation of Adjusted EBITDA in the future, and any such modification may be material. Adjusted EBITDA has important limitations as an analytical tool and you should not consider Adjusted EBITDA in isolation or as a substitute for analysis of results as reported under GAAP. Because Adjusted EBITDA may be defined differently by other companies in the industry, the Company’s definition of this non-GAAP financial measure may not be comparable to similarly titled measures of other companies, thereby diminishing its utility.

American Bitcoin Corp. Investor Relations

ir@americanbtc.com

American Bitcoin Corp. Public Relations

media@americanbtc.com